companies house late filing penalties pay

The company must deliver acceptable accounts by 30 June 2020 to avoid a late filing penalty. Companies House filing deadlines and penalties A reminder that list will have will pay penalties if you dont file your accounts with Companies House visit the appropriate.

Late Filing Penalties Appeals Pdf Free Download

750 for 36 months.

. Pay a penalty for filing your company accounts late Use this service if youve received a penalty notice from Companies House for filing your companys annual accounts late. In tape the police must normally pay necessary statutory penalties for late filing of accounts delivered to the Registrar outside your period allowed by the Companies. You must explain why you unable to pay the late filing penalty. You can pay the penalty by BACS by clearly stating the company number on the bank transfer and using it as the reference.

How to pay late filing penalty by installment. Punishments for late documenting. MyRegistry help myRegistry help. The late filing penalty is normally 5 of unpaid taxes for each month or portion of a month that your return is late.

You should make it payable to companies house late filing penalties with your company name and number on the reverse of the cheque. It may be possible to pay your late filing. Fraudulent appeals 6 8. The late filing penalty is much higher than the late payment penalty.

Firstly if you are to pay for the penalty by cheque please write the cheque payable to Companies House. You can be fined and your company struck off the register if you do not send Companies House your accounts or. In the event of an unsuccessful appeal a break is to be provided to companies in order to pay any late filing penalty. You should email your remittance to lfpfinancecompanieshousegovuk on the same date as the payment is sent clearly indicating the company name and number.

Companies House will charge you a penalty if you file your accounts late. The updated guidance builds on previous measures introduced on 18 March 2020. Companies House will then review your proposal and will let you know if they approve your request. We hold and update 16 registers including Jersey companies business names foundations partnerships and security interests.

Filing your Companies House accounts. 375 for 13 months. The automatic extensions granted by the Corporate Insolvency and Governance Act will come to an end for filing deadlines that fall after 5. Late payment penalty will be charged even if you pay less than what is actually due.

But as we issue around 180000 late filing penalties each year we want to make. A further penalty of 5 will be charged if youve not paid after 12 months. Standard paragraph about benefits of e-filing 5 6. 1500 for more than 6 months.

Universally your company may pay your late filing penalty by a number of methods acceptable with Companies House. You may pay your late filing penalty by cheque and by bank. Appeal a penalty for filing your company accounts late. The amount theyll charge will depend on how late you are filing.

If they were not delivered to Companies House until 15 July 2020 the company would get a. Penalties are docketed as liens against the employer in the Superior Court and collection action is taken to. You must pay the late filing. If you still havent made a monthly or quarterly payment in full after 6 months youll be charged an additional penalty of 5 of the amounts unpaid.

Write to Companies House with your proposed late filing penalty instalment payment plan. Thereafter you have to send the cheque to the correct Companies House offices. Pay late filing penalty by Cheque. We wanted to build something to let them easily pay online.

It is very important for all small business owners freelancers and contractors of United Kingdom to make tax payment within the declared deadline. Background to Late Filing Penalties 4 2. If you file late annual accounts at Companies House two years in a row the late filing penalties are automatically doubled. Documentary evidence 5 7.

Use this service to appeal a penalty from Companies House for filing a companys annual accounts late. Penalties With Companies House. LFP appeals manual Companies House 3 Contents Introduction 4 1. Payment by instalments 5 5.

File your dormant accounts AA02 Apply for a Companies House online filing presenter account. Time allowed for the delivery of accounts 4 3. For example if you owe 1000 your late filing penalty wont be more than 250. At the moment people can only pay their late filing penalties by phone or sending a cheque.

How to pay company house penalties. However this amount will not exceed 25 of your unpaid taxes. Further detail of these previous. Pay a penalty for filing your company accounts late.

This should be returned to us with the remittance slip. The penalty is doubled if your accounts are late 2 years in a row. These charges apply to private limited companies. In addition to financial charges anyone viewing your company details on the register will see that your accounts are outstanding andor they were delivered late at some point in the past.

The reference number on the penalty notice. Wed much rather companies file their accounts on time to keep the public register as up-to-date as it can be. 150 for up to 1 month. The level of the penalty imposed.

To sign in to or. Provisions for extending the time allowed for filing 5 4. The punishment is mult. Additional support is to be provided to companies for payment of late filing penalties by way of payment plans in order to spread the cost.

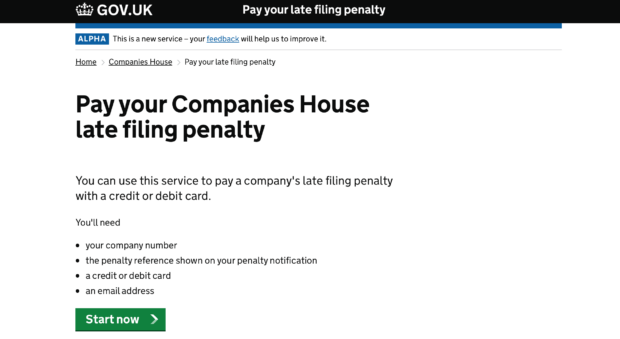

Use this service to pay a companys late filing penalty. Companies House does not verify the accuracy of the information filed link opens a new window Sign in Register For Information. In addition penalties for failure are assessed at up to 5000 for the first twenty days and up to 5000 for each ten-day period thereafter. Youll need to pay punishments if you dont file your accounts with Companies House by the due date.

You can pay companies house penalties by cheque bank transfer known as BACS or by creditdebit card.

Late Filing Penalties Appeals Pdf Free Download

Late Filing Penalties Appeals Pdf Free Download

Late Filing Penalties Appeals Pdf Free Download

Service Assessment Paying Late Filing Penalties Online Companies House

Posting Komentar untuk "companies house late filing penalties pay"